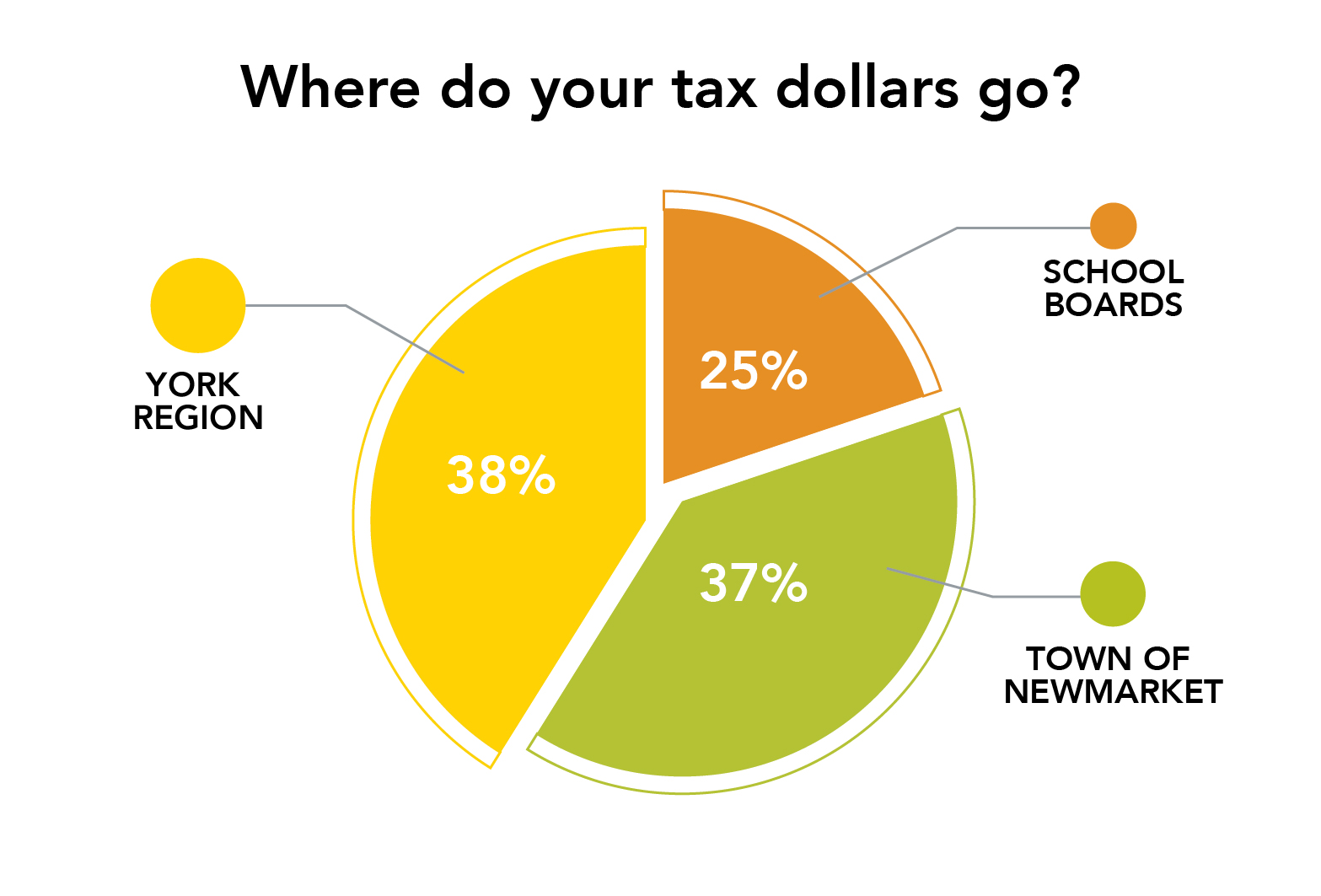

The Town of Newmarket's primary funding source is property tax which is divided between the Town of Newmarket, York Region and the school boards. Property taxes enable the Town to provide the high quality of municipal programs and services that Newmarket residents are accustomed to.

Property Tax Due Dates.

Interim property tax bills are issued in January each year. The 2026 due dates are:

- Wednesday, February 25, 2026

- Wednesday, March 25, 2026

- Monday, April 27, 2026

Final property tax bills are issued in June each year. The 2026 due dates will be in late July, August and September.

If you receive a Supplementary or Omitted Assessment Notice from MPAC you will receive a property tax bill in late fall.

For your convenience, the Town offers a number of payment options for property taxes. Learn more by viewing our Property Tax Payment options webpage.

Note: Please contact our office before the instalment due date(s) if you don’t receive a tax bill. Failure to receive a tax bill or notice does not excuse a taxpayer from the responsibility for payment of the taxes nor relieve the liability for Penalty/Interest.

Important! The Town of Newmarket is not affiliated with any third-party payment organization not listed on our website.

To make changes to your tax account, including pre-authorized payments, please contact the Town of Newmarket directly at [email protected]. Account changes made through third party organizations will not be sent to the Town of Newmarket to process.

Breakdown of where your taxes go

The following outlines the average household cost per day for various Town services:

The Town of Newmarket determines your property taxes by multiplying your current value assessment (determined by the MPAC) by the Town's tax rate, the Region of York's tax rate and the provincial education tax rate.

If you have questions about your property assessment please contact the Municipal Property Assessment Corporation (MPAC).

Learn more about property taxes below:

Obtaining a Statement of Account, Receipt, or Tax Bill

If you require a current Statement of Account, Receipt, or Tax Bill for your property, you may request to receive one electronically via email or standard mail. A Statement of Account may be required by your financial institution if you are renewing a mortgage or refinancing. Please note that ordering a Statement of Account, Receipt or Tax Bill is subject to a fee.

- To receive your statement via email, please

fill out this request form.

- To receive your statement by mail, please call 905-895-5193 from 8:30 a.m. to 4:30 p.m.

Obtaining a Property Tax Certificate

If you are moving, your lawyer will require a Tax Certificate. Your lawyer may fill out a

Tax Certificate Request Form to obtain this document.

Supplementary/Omitted Tax Billings

Property Assessment Change Notices are issued for additional assessment (such as swimming pools, decks or other additions), new homes or property class changes. The property tax dollars associated with the changes are retroactive to the date of occupancy / purchase, or when the renovation or alterations were completed.

Please note the

Municipal Property Assessment Corporation (MPAC) assesses your property for the additional assessment, a new home or a property class change which could take up to three years to occur.

The Town issues your supplementary/omitted tax bill(s) and payments are typically due in two instalments. Depending on the determined assessment, the additional property taxes may be in the thousands of dollars. The Town may be able to assist in preparation for the imminent supplementary/omitted tax bill(s) to minimize the impact of this bill. Please contact the Customer Service Department for additional information and assistance.

Learn more about

what contributes to property tax increases

Municipal Property Assessment Corporation

- Call: 1-866-296-(MPAC) 6722

- 1-877-889-(MPAC) 6722 TTY

- Fax: 1-866-297-6703

- Web:

www.mpac.ca

- Write: P.O. Box 9808, Toronto, Ontario M1S 5T9

- Visit: 100 Via Renzo Dr. Suite 302, Richmond Hill, Ontario L4S 0B8

Learn more about your property assessment at

About my Property.